The simple answer is yes, yes you can use equity release to buy a second home but you still need to be aware of the implications and costs of purchasing a second home.

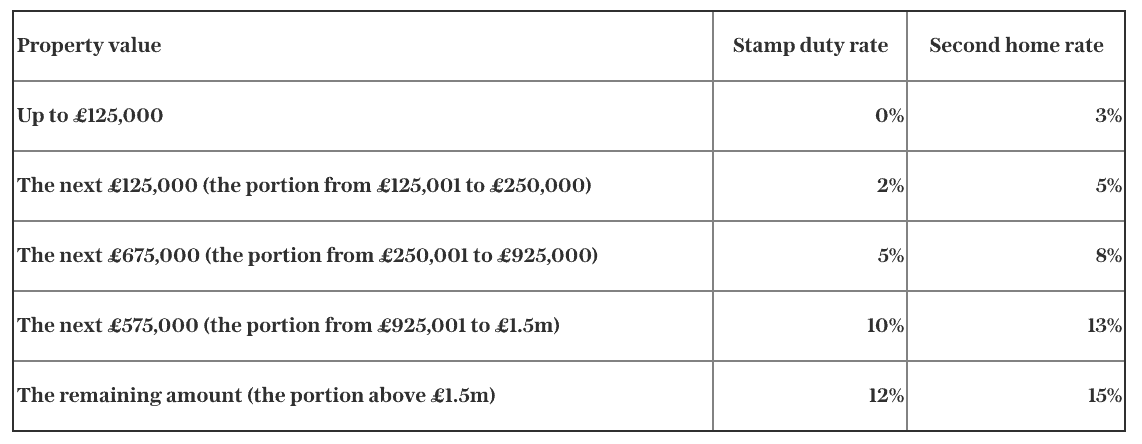

How much stamp duty will you pay on a second home?

If you own a property and are buying a second home, you’ll usually have to pay at least 3 per cent on top of the normal stamp-duty rates, depending on the second property’s value.

(Information via The Telegraph)

Buy to let mortgages

If you’re buying your second home to rent out then you will need a ‘buy to let’ mortgage. Lenders will want to look at the rental income from the property you’re buying, as well as your personal income and circumstances. They may also want to do a ‘stress test’ to check you’ll be able to keep up with payments should interest rates rise.

Second home mortgage

If you’re simply after a second home, there are two main ways to pay for it. You can remortgage your existing property, or, if you’re an older homeowner, release equity.

Remortgage

There are numerous remortgage options to choose from across mainstream and specialist lenders. When comparing mortgages, remember to factor in the overall cost of any deal – including arrangement fees – rather than basing your decision on the headline rate alone.

Equity release

If you are aged 55 or over, you may want to consider equity release as a way to unlock your existing property wealth. The most popular equity-release product is the lifetime mortgage, where you receive a tax-free lump sum generated from the positive equity in your home. Your lifetime mortgage is repaid when you die or move into long-term care, generally through the sale of your home.

We suggest always seeking professional advice before making any decisions so that you can make sure you are getting the best possible deal available and not setting yourself up for financial risk.