- All

- Financial Advice

- Financial Planning

- Insurance

- Mortgages

- Wealth Management

How to Securely Pass Your Pension to Loved Ones

Three tips for passing your pension on to your loved ones Do you consider your pension an asset like property, ...

Read More How much is enough to support your lifestyle?

How much is enough to support your lifestyle? If you don't know, you don't have a financial plan. Do you ...

Read More Why financial planning needs to be designed to support your lifestyle

Many people invest their money to get the best returns possible, and the financial services industry encourages this (it helps ...

Read More Understanding Inheritance Tax (IHT) Liability

Will I have an inheritance tax bill? It's a common misconception that inheritance tax only affects the extremely wealthy. However, ...

Read More Why a Financial Planner is Like Your Personal Trainer: Achieving Financial Fitness

Many of us recognise the immense value of a personal trainer in the fitness world. They provide personalised workout plans, ...

Read More Rethinking Retirement: How the Concept Has Evolved and How We Help Our Clients Plan and Prepare

Retirement has long been considered the golden years of one's life, a period to enjoy the fruits of decades of ...

Read More Babyboomers release cash from homes in record numbers

There has been a significant rise in the number of homeowners tapping into property wealth through equity release schemes. The ...

Read More Navigating Life Transitions with Life-Centred Financial Planning

Life transitions, such as getting married, having children, changing careers, or retiring, can be exciting and challenging. Life-centred financial planning ...

Read More Information you need to provide to apply for a mortgage

When applying for a mortgage, lenders must be sure they know whom they are lending to and that you won’t ...

Read More House valuations: What you need to know

There are a number of reasons that you may need to get a house valuation done. The four most common ...

Read More How to remortgage your house and what you need

Remortgaging your house can generate huge savings. But it's important to know what you're doing before you get into the ...

Read More What is a Relevant Life Policy and why do you need one?

Relevant Life Insurance is a type of life insurance that is owned and paid for by a business. It provides ...

Read More Are you overspending on your mortgage?

A recent study carried out by MoneySuperMarket estimated that 800,000 people are currently spending more on their mortgage than necessary. ...

Read More How could equity release benefit retirees living alone?

Using an Equity Release scheme to release capital from your home is a good way for those over 55 to ...

Read More How can you help your employees with their financial worries?

Financial worries can be a primary cause of stress for many employees. Money worries don't just affect an individual's financial ...

Read More What are Defacqto ratings and how can they help you?

Defaqto is a service that compares financial products. Defaqto Ratings are ratings based on facts rather than opinions. Ratings are ...

Read More Are you taking a risk by not having income protection?

Did you know that eight out of ten mortgage holders have no income protection at all? That is a shocking ...

Read More What you need to know about converting your property into an HMO

A house in multiple occupation (HMO) is a property rented out by at least 3 people who are not from ...

Read More Can I use a lifetime mortgage to release equity from my buy to let property?

If you are thinking about purchasing or borrowing against, a Buy To Let property, it may be in your interest ...

Read More Buy to Let mortgages for older borrowers

Getting a Buy To Let mortgage as an older borrower can be more difficult but it's definitely not impossible. There ...

Read More Why is interest only better than a repayment mortgage for Buy To Let mortgages?

When you take out a mortgage there are two ways of repaying it. You can either go for an interest-only ...

Read More What is Joint Venture funding and how does it work?

Joint Venture Funding, often referred to as Equity Development Finance, is where two or more developers pool their resources to ...

Read More Can I get an investment mortgage as a Foreign national?

If you are a foreign national, a non-UK passport holder living and working outside the UK, looking to invest in ...

Read More Can I get a mortgage as an Expat?

Getting a mortgage as an expat living in the UK isn't always easy as many lenders will view you as ...

Read More HOW DOES DEBT CONSOLIDATION WORK?

Not only does debt consolidation simplify your monthly budget, it could save you thousands in interest charges. But, there are ...

Read More WHAT IS A GIFTED DEPOSIT?

If you're looking to get a mortgage and have a friend or family member who is willing to help you ...

Read More WHAT IS A HELP TO BUY ISA?

If you're a first-time buyer, you could get up to £3,000 towards buying your first property with a Help to ...

Read More WHY DO SOME MORTGAGE BROKERS CHARGE A FEE?

A mortgage broker is a financial adviser who offers advice to those specifically looking to take out a mortgage. When ...

Read More FCA’s Press Release on Mortgage Payment Holidays

The FCA released a press release on Friday 22nd May 2020, any these impact you and do you need to ...

Read More When is the best time to remortgage?

A remortgage is where you take out a new mortgage, often with a different lender, on a property that you ...

Read More What should I ask my mortgage advisor about Lifetime Mortgages?

Taking out a Lifetime Mortgage is a big decision, which is why it's always worth talking to a mortgage advisor ...

Read More Why are more women interested in lifetime mortgages?

Research carried out by the Equity Release Council found that single women over 55 accounted for 25% of new equity ...

Read More When should I remortgage? Could it save me money?

A national survey recently conducted by Which? found that over 1/3 of mortgage borrowers are unaware that a remortgage could ...

Read More What does a mortgage broker do?

Did you use a broker last time you took out a mortgage? According to a recent study by Legal & ...

Read More What’s the difference between equity release and a lifetime mortgage?

We've seen the terms Equity Release and Lifetime Mortgage used interchangeably a lot recently. So we put this article together ...

Read More Could your home increase your pension pot?

The cash tied up in your home could help you have the retirement you've dreamt about. A growing number of ...

Read More Buy to Let landlords: Do you know what you need to know?

To avoid getting into trouble, or losing money, it's vital to keep up to date with the latest law changes ...

Read More Is equity release a safe option?

Equity release has become highly popular in recent years. Those over the age of 55 can use equity release plans ...

Read More Can life cover insurance improve your mental health?

Worrying about what will happen to your family in the event of your death can be incredibly stressful, putting life ...

Read More How do you give your equity release application the best possible chances of success?

Applying for equity release isn't always a smooth process. There are a lot of options out there from multiple lenders, ...

Read More When should I remortgage my home?

It's easy to forget about remortgaging and to therefore end up on your bank's standard variable rate mortgage. But remortgaging ...

Read More Is a Help to Buy Equity Loan right for you?

A question that's important to ask about ANY form of loan. There are an increasing number of loan options on ...

Read More Do you have a retirement plan in place?

Not all care costs are state funded and it's never too soon to start planning for your retirement. Forecasts show ...

Read More What are the best ways to fund home improvements?

According to Zoopla, converting a loft would typically set you back around £20,000, while swapping the garage for living space ...

Read More How can female millennials better their financial futures?

Almost 60% of women do not engage in aspects of their financial well-being: investing, insurance, retirement and other long-term planning. ...

Read More Is equity release right for you? Are there other options to consider?

New research by Canada Life Home Finance has shown that home owners taking out equity release mortgages on their properties ...

Read More What are the best mortgages for first-time buyers?

The number of people buying their first home has hit its highest level in 12 years according to data from ...

Read More Do I really need income protection insurance?

Each year one million people in the UK find themselves unable to work due to a serious illness or injury. ...

Read More Should you you pay off your child’s student loan or help them with their mortgage?

Since tuition fees trebled in 2012 students have been graduating with loans averaging £50,000 if maintenance costs are included. If ...

Read More FEATURED. One of the nation’s top advisors.

It's important to find an advisor you know, trust and can rely on to put your needs first. We are ...

Read More How do joint mortgages work?

Did you know that you can get a mortgage that has both of your names on it rather than just ...

Read More How much does equity release cost?

The costs that build up over time with an equity release plan could be significant, with some initial charges too. ...

Read More Can I use equity release to help my family?

Yes, you can use equity release to help support family members. Equity release is a means of retaining use of ...

Read More Do women pay less for motor insurance?

According to a study by price comparison site Confused.com women are paying less for car insurance than men because they ...

Read More How could your credit file help you to get a good mortgage deal?

There are plenty of things to think about when it comes to getting a mortgage. Should you be using the ...

Read More Do investment providers need to adapt their language to reach more women?

New research has found that there is a £15bn gap between the value of investments made by millennial and generation ...

Read More Can I use equity release to buy a second home?

The simple answer is yes, yes you can use equity release to buy a second home but you still need ...

Read More Are you looking to reduce the cost of your life insurance?

A recent study by Consumer Intelligence found that 18% of consumers in the UK are considering cutting back on their ...

Read More When should you consider equity release?

Over £1bn of housing wealth was unlocked between June and September 2018 and equity release lending is showing no signs ...

Read More Should more carers have life insurance?

The simple answer, yes! Carers - non-professional people who are looking after family or others who are sick, elderly or ...

Read More How is equity release evolving?

Equity release has become quite a popular option for people who are looking to release capital from their properties without ...

Read More Can encouraging children and parents to ‘talk money’ improve parents’ debt levels?

A pilot course that was set up in Wales to help parents teach their children about money also improved parents’ ...

Read More Do you underestimate your life insurance needs?

Many are putting their families at potential risk should the worst ever happen. This was among the findings from price ...

Read More How can I use equity release to buy a holiday home abroad?

If you're dreaming of a holiday home in the sun equity release is one option that could help you fund ...

Read More What’s in the new budget that affects me as an individual?

Philip Hammond has delivered his third Budget as chancellor, here are some of the key takeaway points... The personal allowance ...

Read More How can I improve my credit rating?

Before you apply to borrow money it's always a good idea to make sure your credit rating is in good ...

Read More What happens if you can’t work due to a accident or sickness?

Let me give you a quote to ensure your mortgage and bills are covered. Call me on 0203 003 5161 ...

Read More Are women underinsured compared to men?

Alongside the gender pay and gender pensions gaps emerges the gender protection gap. Women are underinsured compared to men and ...

Read More Could you significantly reduce your mortgage term?

Your circumstances may have changed since you first took out your mortgage. You may be able to pay off more ...

Read More How will interest rates affect you as a saver or a borrower?

Interest rates for savers have been pushed up to their highest level in almost three years whilst the change is ...

Read More Do you know about the HMO changes that came into effect on Monday?

All brokers should be aware of the HMO licensing changes that came into effect on Monday this week. Any property ...

Read More How you can help your employees manage their finances better

If you're an employer you're in a unique position to offer help to your employees so that they can manage ...

Read More Stay up-to-date with the latest buy-to-let research

The latest results from a BDRC Continental's Landlord Panel survey show that mortgaged Buy To Let landlords generate an annual ...

Read More Equity release schemes 2018: 10 Things you need to know

Equity release schemes have increased in popularity throughout 2018 and if it's something you're considering here are 10 things you ...

Read More Have Brits abandoned saving for rainy days?

https://www.youtube.com/watch?v=pdo68qrEJNs Only "1 in 3 respondents own insurance to protect against illness/disability". There is growing concern about the number of ...

Read More Lenders are offering retirement interest-only mortgages

An increasing number of lenders have been lining up to release a new wave of home loans that let older ...

Read More 17.6 Million Brits are not financially resilient

Zurich UK has revealed that millions of UK adults do not feel financially resilient and that they would not be ...

Read More Brits more likely to have pet insurance than income protection

New research by Epoq Legal reveals that 32% of those surveyed have pet insurance compared to a quarter with some form ...

Read More How safe an option is equity release?

If you're over the age of 55 and looking to free up cash from your property to fund home improvements, ...

Read More Millions of mortgage holders without life insurance

Although life insurance is not compulsory for mortgage holders, it's highly recommended to make sure the mortgage is paid off ...

Read More Should you remortgage?

Remortgaging is when you take out a new mortgage on a home you already own. This allows you to replace ...

Read More What’s More Important: Your Credit Score or Report Data?

A good credit history gives you a good credit score which means you should have easy to access to credit, ...

Read More How does my address influence a credit check?

Your credit rating is based on your information only. Where you live, your neighbours and past tenants of your home ...

Read More Lifetime mortgage or retirement interest-only – which is right for me?

Older homeowners now have an extra home finance product to consider - retirement interest-only (ROI) mortgages. These products allow homeowners ...

Read More 4.5 Million dads don’t have life insurance

According to research from Scottish Widows more than 58% of men in the UK with dependent children have no life ...

Read More How to build credit history without a credit card

Building up a credit history is not always easy. And, whilst the conventional method would have been to take out ...

Read More Free life insurance for parents – is it worth getting?

Post Office Money is offering up to £120,000 worth of free life insurance to parents with a child/children age four ...

Read More New ‘Pensioner Mortgages’ to receive Treasury backing

Retirement mortgages are starting to appear on the market as the Treasury is set to give its backing after saying ...

Read More Things that might be affecting your credit rating

1. Late payments Late payments will be flagged up to potential lenders. Whilst a single late payment should not have ...

Read More How to remove negative markers on your credit report

Your credit report is like a CV of your borrowing history that gets updated on your behalf. It exists to ...

Read More What is an offset mortgage and what are the benefits?

An offset mortgage delivers a tax-free savings return by setting your savings and current account against your mortgage debt. As ...

Read More Babyboomers release cash from homes in record numbers

There has been a significant rise in the number of homeowners tapping into property wealth through equity release schemes. The ...

Read More Are comparison sites a good place to source buildings insurance?

Comparison sites have become increasingly popular when it comes to sourcing building insurance, but, are they getting you the best ...

Read More Can your credit report help when moving house?

Yes, is the simple answer, and in many ways. Today we're going to talk about how your credit report can ...

Read More 10 Things you probably don’t know about blacklists

If you've been refused credit in the past you may be concerned that your past may affect your future. This ...

Read More My Finance Centre – What it is and how to get started

Welcome to My Finance Centre. My Finance Centre is an easy to use, platform that will help you to manage ...

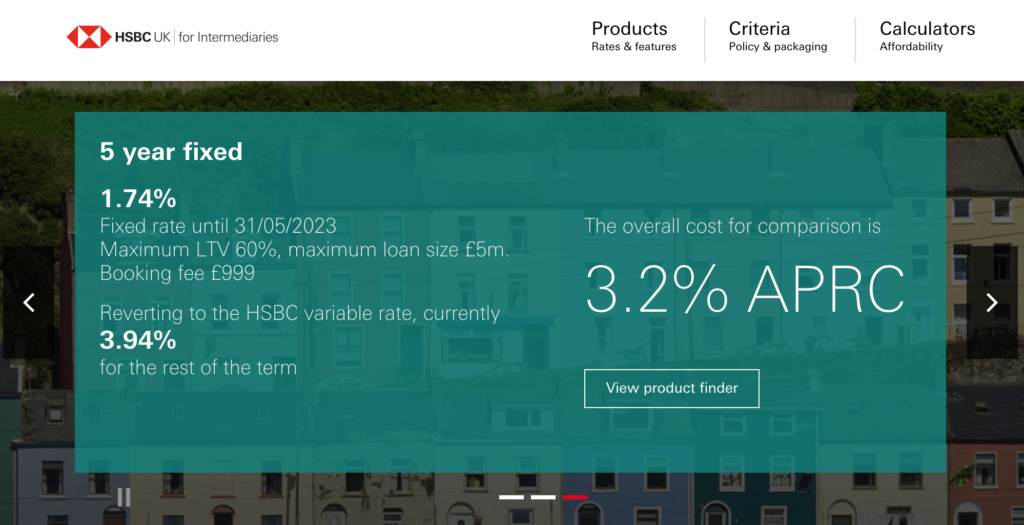

Read More We are one of few brokers with access to HSBC

We are delighted to announce that we are now an official intermediary for HSBC. We are one of few, FCA ...

Read More BTL Energy efficiency rate rule changes: What you need to know

There are changes you need to know about... From 1st April landlords will need to ensure their properties have an ...

Read More Billions in buy-to-let tax relief available despite changes

Despite the changes being made to buy-to-let tax, due to be phased in by 2020, buy-to-let landlords will still enjoy ...

Read More New energy laws could trip up buy-to-let lenders

On 1 April new regulations will come into force making it illegal for landlords to start new tenancies without the ...

Read More House prices might be falling but we’re still happy to buy

Despite the fact that house prices are expected to fall in 2018 there has been a steady increase in mortgage ...

Read More Ombudsman Services is to withdraw from property

Ombudsman Services is a multi-sector organisation that provides dispute resolution services for sectors including communications, energy and copyright licensing sectors. ...

Read More Babyboomers release cash from homes in record numbers

New figures show that £3bn of cash was taken out of British properties in a year for the very first ...

Read More Over-65s spend on average £10,400 on home improvements for retirement

One in three over-65s plan to make sure their home is 'retirement ready', according to new research from Key Retirement. ...

Read More Getting a mortgage when you’re over 50

We are living longer, healthier and more active lives nowadays and some of us work well past 65 seeing as ...

Read More Do you pay tax on equity release?

Increasing numbers of older homeowners are using equity release schemes to release tax-free cash from their properties. The equity released ...

Read More Millions of over-50s could be 'paying too much' for life insurance

Millions of Britons are still paying money every month into a basic type of insurance called an over-50s life plan, ...

Read More Current mortgage deals could be 'dangerous' as house prices weaken and rates rise

Looming interest-rate rises and a stagnant housing market mean first-time buyers could end up trapped and paying some of the ...

Read More Is a tracker mortgage a good idea if interest rates are set to go up in 2018?

The number of homeowners opting for a variable rate when they remortgage has dropped 75 per cent over the past ...

Read More Do you really need life insurance?

Not EVERYONE needs life insurance. But, if your children, partner or other relatives depend on your income to cover the ...

Read More How does home reversion work and is it right for you?

Home reversion involves a company buying your home or a part of it. In return you get a cash lump ...

Read More How does a lifetime mortgage work?

A lifetime mortgage is when you borrow money secured against your home, provided it’s your main residence, while retaining ownership. ...

Read More Why One In Three Use Equity Release To Clear Their Mortgage

Due to the fact that property values have risen over the long-term equity release is a good way for older ...

Read More Millions of over-50s could be ‘paying too much’ for life insurance

Millions of Britons are still paying money every month into a basic type of insurance called an over-50s life plan, ...

Read More Stamp duty scrapped for first time buyers on property up to £300,000

First time house buyers will no longer need to pay stamp duty on properties worth up to £300,000. Mr Hammond ...

Read More UK interest rates: What will a rise mean for YOUR mortgage?

The Bank of England has recently increased interest rates from the record low of 0.25 per cent to 0.5 per ...

Read More Could You Be Missing Out on Tax-Efficient Life Insurance?

There are 1.9 million limited companies in the UK and around 78% of these employ no more than four people. ...

Read More First interest rate rise in 10 years adds to UK mortgage burden

The recent rise in interest rates from 0.25% to 0.5% could add an extra £22 a month to average variable ...

Read More Increasing number of under 35s take out life insurance

New figures reveal the number of people aged 35 and under that are taking out life insurance has increased from ...

Read More Current mortgage deals could be ‘dangerous’ as house prices weaken and rates rise

Looming interest-rate rises and a stagnant housing market mean first-time buyers could end up trapped and paying some of the ...

Read More Are you self-employed and at risk of financial crisis?

Nearly 2 million self-employed people in the UK are unable to save any money each month leaving them vulnerable to ...

Read More Do you have life insurance?

According to LifeSearche’s 2017 Health, Wealthy and Happiness report more than two thirds of the UK adult population either don’t ...

Read More Will you be affected by the new buy-to-let tax?

Higher-rate taxpayers can no longer offset all their mortgage interest against rental income before calculating the tax due. This will ...

Read More